Preface:-The moment when it was announced by the Hon’ble Finance Minister that the exemption is being provided to the levy of Education Cess and Secondary & Higher Education Cess, there was a sigh of relief that there will be reduction in the rate of service tax. Moreover, it was represented by the trade that the maintenance of separate accounts for Education Cess & SHE Cess consumes lot of time and instead, the tax rate should be consolidated and the appropriation of tax as Education Cess and SHE Cess should be done by the Centre at its own level. Hence, when it was heard that Education Cess and SHE Cess are abolished, the trade was happy that their request has been considered by the government. However, this feeling was just for few seconds because in the very next moment, a new levy called as ‘Swachh Bharat Cess’ (SBC) was revealed that was to be levied at the rate of 2% on the value of services under section 119 of the Finance Act, 2015 on specified services from a date to be notified in future. This news put all the service tax assessees in distress as the rate of service tax increased from 12% to 14% and a new levy in the form of ‘SBC’ was to be implemented in near future on specified services. Consequently, this lead to putting the assessees in the same situation as before and only the name of Cess was changed. This new levy of ‘SBC’ has been finally revealed by the government by way of issuance of various service tax notifications, circular and FAQs and this new levy is to have effect from 15.11.2015. This article is an attempt to analyse the statutory provisions of this new levy, ‘SBC’.

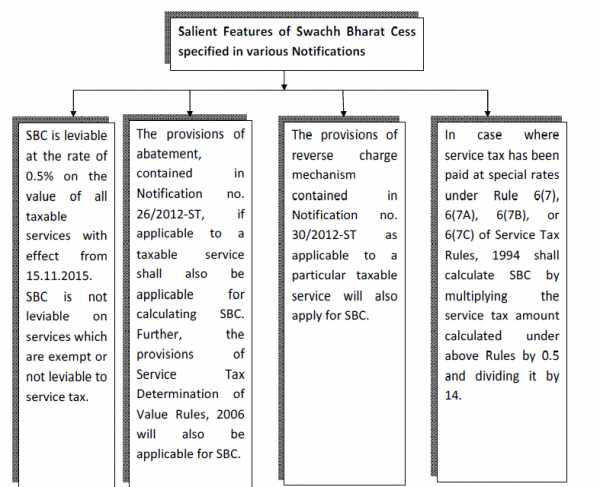

Overview of the statutory provisions and clarifications pertaining to SBC:-The government has issued a number of notifications, FAQ, circular etc. for levy of SBC. The provisions are summarized for quick reference as follows:-

Apart from provisions specified in various notifications, a circular has also been issued which gives accounting code for payment of SBC, interest pertaining to SBC and penalty pertaining to SBC. Moreover, a ‘FAQ’ has also released which seeks to clarify various doubts and issues pertaining to SBC. The highlights of the clarification given in the FAQs are as follows:-

- SBC would be levied, charged, collected and paid to Government independent of service tax. This needs to be charged separately on the invoice, accounted for separately in the books of account and paid separately under separate accounting code as notified. SBC may be charged separately after service tax as a different line item in invoice. It can be accounted and treated similarly to Education cesses.

- SBC is not integrated in the Cenvat Credit Chain. Therefore, credit of SBC cannot be availed. Further, SBC cannot be paid by utilizing credit of any other duty or tax.

- As SBC is not integrated in the Cenvat Credit chain and reversal under Rule 6 is payment of amount equal to 7% of the value of exempted services, hence, reversal of SBC is not required under Rule 6 of Cenvat Credit Rules, 2004.

- As regards Point of Taxation, since this levy has come for the first time, all services (except those services which are in the Negative List or are wholly exempt from service tax) are being subjected to SBC for the first time. SBC, therefore, is a new levy, which was not in existence earlier. Hence, rule 5 of the Point of Taxation Rules would be applicable in this case. Therefore, in cases where payment has been received and invoice is raised before the service becomes taxable, i.e. prior to 15th November, 2015, there is no liability of Swachh Bharat Cess. In cases where payment has been received before the service became taxable and invoice is raised within 14 days, i.e. upto 29th November, 2015, even then the service tax liability does not arise. Swachh Bharat Cess will be payable on services which are provided on or after 15th Nov, 2015, invoice in respect of which is issued on or after that date and payment is also received on or after that date. Swachh Bharat Cess will also be payable where service is provided on or after 15th Nov, 2015 but payment is received prior to that date and invoice in respect of such service is not issued by 29th Nov, 2015.

In depth analysis of the above cited provisions:-On perusing the above provisions and clarifications, the following observations are worth noting:-

- The notification no. 22/2015-ST dated 06.11.2015 seeks to levy SBC at the rate of 0.5% on taxable value of all services with effect from 15.11.2015. It is pertinent to note that section 119 of chapter VI of the Finance Act, 2015 specifies that SBC would be leviable at the rate of 2% on the value of all or specified services. This notification gives exemption to the levy of SBC beyond 0.5% thereby meaning that in the statue the rate of SBC is 2% but it is vide this notification that SBC will be leviable at the rate of 0.5%. This reflects the probability of fluctuating this SBC from time to time within a range of 2% of the value of taxable services. Moreover, in the section 119 of the Finance Act, it was indicated that SBC will be levied on certain specified services but this notification seeks to levy SBC on all services except exempted services.

- The new levy SBC is being implemented with effect from 15.11.2015, in the mid of month which is not at all understandable and has increased complexities. The assessees will face practical difficulties in reflecting the amount of SBC for the month of November in the service tax return. Moreover, the government has also increased its task to make suitable changes in the return format. The new levy should have been made effect from beginning of a new quarter so that compliance could have been made little easy.

- With the abolishment of Education Cess and SHE Cess, the assessees were under the impression that their compliance would reduce slightly as it was mandatory to maintain separate records for Education Cess and SHE Cess and there was also restriction that the cenvat of Education Cess and SHE Cess could be utilised only for payment of Education Cess and SHE Cess. However, there has been no reduction in the compliance mechanism as the assessees are once again required to maintain separate records for the new levy of SBC. There is also separate accounting code for payment of SBC, its interest and penalty.

- SBC is not cenvatable as stated in the FAQ released and available on CBEC website. This has tremendous adverse consequence to the assessees as SBC will become the cost and will not be available as cenvat credit. This is the major drawback of new levy as it ignores the concept of ‘cascading effect’. Moreover, as SBC is not cenvatable, service tax paid on input services consumed by exporters will form cost of exported goods/services thereby leading to export of domestic taxes abroad which will definitely go against the ‘Make in India slogan’ of the government. Further, it is remote possibility that the exporters will be able to claim refund of the SBC paid by them on various input services. The consequences of making SBC non-cenvatable are extremely adverse and far reaching. Hence, it is prayed that amendment is made in the Cenvat Credit Rules, 2004 as soon as possible because when all the provisions applicable to service tax are made applicable to this SBC, then the credit of SBC should also be allowed.

- The major issue that is haunting the minds of the assessees is the absurdity in the effective implementation date of this new levy, SBC. Although, the notification no. 21/2015-ST dated 06.11.2015 specifies that the provisions of chapter VI of the Finance Act, 2015 pertaining to SBC will be applicable from 15.11.2015 but the applicability of Point of Taxation Rules, 2011 seeks to contradict this notification. This is for the reason that the section 119(5) of Chapter VI states that “The provisions of Chapter V of the Finance Act, 1994 and the rules made thereunder, including those relating to refunds and exemptions from tax, interest and imposition of penalty shall, as far as may be, apply in relation to the levy and collection of the Swachh Bharat Cess on taxable services, as they apply in relation to the levy and collection of tax on such taxable services under Chapter V of the Finance Act, 1994 or the rules made thereunder, as the case may be.” Consequently, the provisions of Point of Taxation Rules, 2011 are also made applicable due to which in certain circumstances, SBC is leviable even if service was provided prior to 15.11.2015. Moreover, the clarification of FAQ regarding applicability of Rule 5 itself is doubted. Furthermore, the time period for issuance of invoice is wrongly mentioned as 14 days instead of ’30 days’. The detailed analysis of the provisions of POTR with respect to SBC are as follows:-

Rule 4 of the Point of Taxation Rules, 2011 where there is change in effective rate of tax:- According to this Rule, whenever there is change in effective rate of tax, the occurrence of any two events out of three events will determine the rate of tax. The three events are date of provision of service, date of issue of invoice and date of receipt of payment for the service. Whenever any two out of the above cited three events occur, the rate of tax applicable on the occurrence of the said events will be relevant. This can be illustrated by the following example:-

| Date | of | Date of issue | Date | of | Point | of | Whether |

| provision | of | of invoice | payment | to | Taxation | SBC | |

| service | service | Date | leviable? | ||||

| provider | |||||||

| 31.10.2015 | 02.11.2015 | 17.11.2015 | 31.10.2015 | No | |||

| 31.10.2015 | 16.11.2015 | 17.11.2015 | 16.11.2015 | Yes | |||

Rule 5 of the Point of Taxation Rules, 2011 when service has been made taxable for the first time

from a particular date:- According to this Rule, no tax will be payable under following two situations:-

(a) If the invoice has been issued and payment has been received before the date on which service became taxable.

(b)If the payment has been received before the service becomes taxable and invoice has been issued within 30 days from the date of completion of the provision of service.

Rule 7 of the Point of Taxation Rules, 2011 in case of reverse charge mechanism:- This Rule starts with ‘Non-Obstante’ clause and has overriding effect over all the Rules of POTR. Notwithstanding anything contained in these rules, point of taxation in respect of persons required to pay tax as recipients of service shall be the date on which payment is made. If the payment is not made within a period of 3 months from the date of invoice, the point of taxation shall be the date immediately following the expiry of three months from the date of invoice. Furthermore, in case of associated enterprises where the person providing the service is located outside India, the point of taxation shall be the date of debit in the books of account of the service receiver or the date of making payment, whichever is earlier.

If the above cited provisions of Point of Taxation Rules, 2011 are pursued, it is found that the FAQ clarifying that the Rule 5 of the POTR, 2011 will be applicable appears to be erroneous for the following reasons:-

- Firstly, Rule 5 of POTR applies when a new service is taxed for the first time. However, SBC is not a new service rather it is new levy on existing taxable services. Although SBC is taxed for the first time but that cannot lead to conclusion that the provisions of Rule 5 of POTR would come into picture. On the contrary, according to author’s view, Rule 4 and Rule 7 of the POTR are applicable.

- Secondly, the time period of 14 days for issuance of invoice has already been amended as 30 days with effect from 01.04.2012 but the example given refers to the period of 14 days for issuance of invoice.

- Thirdly, there is already contradiction between the provisions of section 67A of the Finance Act, 1994 and the Rule 4 of the Point of Taxation Rules, 2011. The provision of section 67A are produced for quick reference as follows:-

Section 67A of the Finance Act:- Date of determination of rate of tax, value of taxable service and rate of exchange

The rate of service tax, value of taxable service and rate of exchange, if any, shall be the rate of service tax or value of a taxable service or rate of exchange, as the case may be, in force or as applicable at the time when the taxable service has been provided or agreed to be provided.

However, as per Rule 4 of the POTR, the rate applicable at the point of taxation date is to be considered as applicable rate of tax. Say for example, in the situation when rate of tax was increased from 12% to 14% with effect from 01.06.2015. If the service was provided on 28.05.2015 but the invoice was raised on 05.06.2015 and payment was also made to service provider on 07.06.2015, the new rate of tax, i.e., 14% would be applicable as per Rule 4 of POTR, 2011. However, as per section 67A, the rate applicable on the date of provision of service should be considered being 12%. S

Similarly, the SBC is being implemented with effect from 15.11.2015 but if the Rule 4 of POTR, 2011 is made applicable, in certain situation as depicted in situation 2 of example table above, SBC will be leviable even if the service was provided prior to 15.11.2015. This will go against the provision of notification no. 21/2015-ST dated 06.11.2015 which clearly states that SBC is to be implemented with effect from 15.11.2015.

Good bye words:-On one hand, the government is promoting its slogan of ‘Ease of doing business in India’ and ‘Make in India’ while on the other hand, the legislations being introduced are defeating the very purpose of ease of doing business because they are complicating the taxation even more. Not only this, making SBC non-cenvatable, will have direct impact on exports of our Country because it amounts to exporting domestic taxes abroad. Well, all we can say is that although the purpose of this new levy is to make Bharat Swachh but on the contrary, this cess will clean the pockets of assessees!

This article is contributed by CA Pradeep Jain and CA Neetu Sukhwani.